app 1xbet pc

app 1xbet pc

Crise espiralada do Haiti.

O conselho de nove membros poderia ser formalmente estabelecido no Haiti já nesta semana, disse Brian A. 💳 Nichols app 1xbet pc um evento organizado pelo Conselho das Relações Exteriores dos EUA para assuntos do Hemisfério Ocidental (CFR).

forçando mais de 💳 53.000 pessoas a fugir da área nas últimas semanas.

A redução da ajuda crítica, como especialistas alertam que a fome e 💳 as doenças estão disparando.

"Não há crise humanitária maior no mundo hoje do que o está acontecendo app 1xbet pc Haiti", disse Nichols.

Gangs 💳 começaram a atacar instituições governamentais chave app 1xbet pc Port-au Prince no dia 29 de fevereiro, abrindo fogo contra o principal aeroporto 💳 internacional que permanece fechado e atacando delegacia do Haiti duas maiores prisões.

O Escritório de Direitos Humanos da ONU chamou a 💳 situação "cataclísmica", observando que mais do 1.550 pessoas foram mortas e 800 ficaram feridas até o final deste mês.

A criação 💳 do conselho de transição, que terá sete membros com poderes para votar e escolher o próximo primeiro-ministro haitiano não deve 💳 resolver imediatamente os problemas profundamente enraizados no país.

Nichols disse que não há apenas "uma única coisa" necessária para resolver os 💳 problemas do país.

Durante o fórum de uma hora, Nichols foi criticado por Monique Clesca (uma escritora haitiana e membro do 💳 Grupo Montana), coalizão entre líderes civis ou empresariais que recebeu um cargo no conselho transitório.

Julho 2024 assassinato do presidente Jovenel 💳 Mose.

demitir-se assim que o conselho for criado.

Os EUA sempre apoiaram Henry app 1xbet pc primeiro lugar. "Se estamos indo para a frente... 💳 temos que pensar sobre essa política? Foi ruim - O quê podemos aprender com isso?" Podemos admitir um fracasso na 💳 decisão de não fazer nada por ele, mas o problema é:

O destacamento apoiado pela ONU de uma força policial do 💳 país da África Oriental. Ele foi trancado fora o País desde então, já que a violência forçou ao fechamento dos 💳 principais portos para entrada no continente africano

Em Nova York, os membros do painel foram questionados sobre por que as gangue 💳 de controle 80% da cidade não estavam envolvidas app 1xbet pc negociações ou na criação dum conselho transitório.

“Ter um diálogo amplo e 💳 inclusivo entre todos os segmentos da sociedade é certamente algo que vale a pena fazer”, disse Nichols, mas ele afirmou 💳 ainda: o interesse das gangue "não pode ser colocado à frente dos cidadãos comuns cumpridores de leis".

Ele disse que são 💳 necessárias soluções para direcionar por quê as pessoas se juntam a gangues app 1xbet pc primeiro lugar. "Tem de haver acesso à 💳 educação e oportunidades profissionais, bem como programas laborativo", ele diz."

Clesca acrescentou que há uma necessidade de mudar a identidade social 💳 para se concentrar mais na escola e nos empregos.

Também no painel estava Garry Pierre-Pierre, fundador do site de notícias online 💳 The Haitian Times com sede app 1xbet pc Brooklyn. Ele alegou que os políticos haitianos e a elite da nação há muito 💳 tempo apoiam secretamente gangue para servir seus interesses; ele lamentou o fato das diásporas haitianas não terem sido adequadamente consultadas 💳 durante as crises ”.

"A segurança é um problema de curto prazo que pode ser resolvido", disse ele. Mas costurar a 💳 sociedade haitiana, isso será realmente o desafio."

ação "Mãos e Regras" de cada jogador. Tem várias mecânicas de jogo distintas, como "The

Charleston", que é um conjunto de ♣ passes necessários e a passagem opcional das

. O Mahjoong americano é jogado com quatro jogadores usando teles mahmjogg. Mahjung

icano – ♣ Wikipédia co.wikipedia : wiki

A sorte para as habilidades é 7:3. Dito isto,

app 22 bet

"Encourages": O significado por trás da palavra-chave

A palavra "encourages" significa incentivar ou promover algo, no contexto deste artigo, estamosnos referindo 🌧️ à colaboração app 1xbet pc equipe. Trabalhar app 1xbet pc colaboração significa trabalhar juntos app 1xbet pc um projeto, processo ou conceito, com o objetivo de 🌧️ alcançar um resultado melhor do que o que seria possível se cada pessoa atuasse individualmente. Isso inclui brainstorming, criatividade, oferecer 🌧️ habilidades únicas, ver o quadro maior e atingir um objetivo comum.

Minha experiência com colaboração app 1xbet pc equipe

Foi app 1xbet pc uma sala de 🌧️ reuniões de uma empresa que experimentei pela primeira vez a colaboração app 1xbet pc equipe. Nós éramos um time diverso, com diferentes 🌧️ antecedentes e experiências, mas nossa meta era clara: encontrar uma solução para um problema que estávamos enfrentando como empresa. Durante 🌧️ as sessões de brainstorm, fomos capazes de pensar de maneiras criativas e oferecer habilidades únicas, o que levou a soluções 🌧️ inovadoras. Através disso, aprendi sobre a importância da comunicação eficaz entre os membros da equipe e como nossas diferentes perspectivas 🌧️ podem nos ajudar a atingir resultados superiores como time.

Por que a colaboração app 1xbet pc equipe é tão importante?

O seu objetivo: descobrir o que é um nome genérico para Sertaconazol

Na área da medicina, o nome genérico de um 😄 fármaco é uma designação abreviada e única para um princípio ativo ou substância medicinal particular. No caso do fármaco Sertaconazol, 😄 o nome genérico refere-se à substância ativa encontrada nas versões de marcas dessa droga. Abaixo, exploraremos as marcas associadas à 😄 substância ativa do fármaco Sertaconazol e suas respectivas concentrações.

Os benefícios da Sertaconazol: marcas e tipos

A tabela a seguir apresenta as 😄 marcas disponíveis de Sertaconazol, tipo e formulação:%

N.

próxima:apostas grátis hoje

anterior:jogo de dinossauro online

Artigos relacionados

- {up}

- mercado vencedor aposta ganha

- bet dá sorte

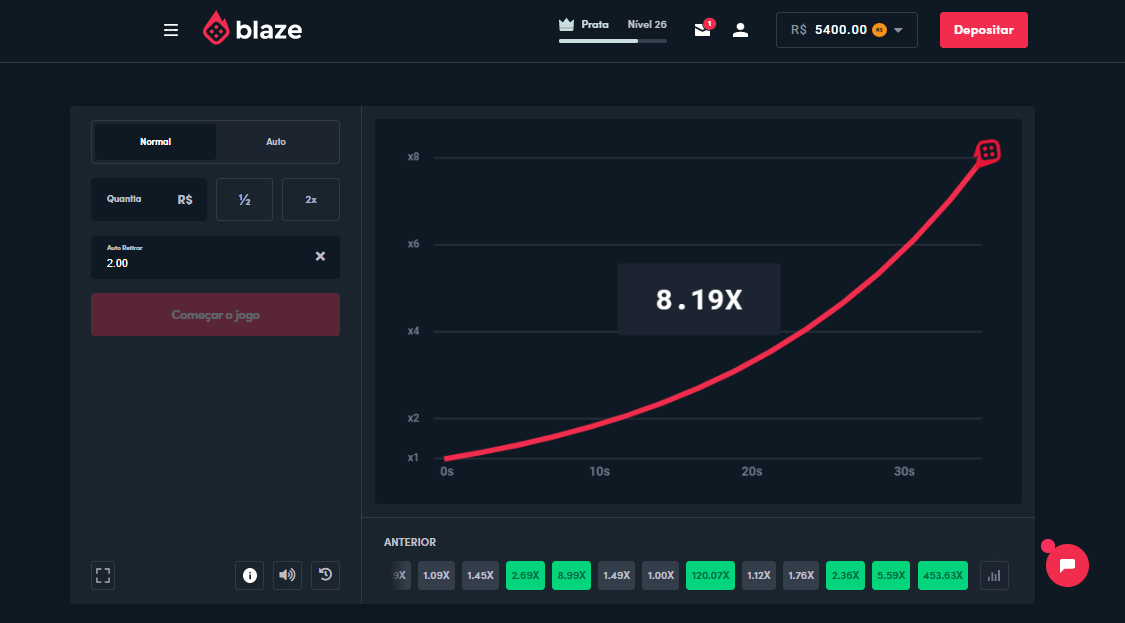

- como as casas de apostas ganham dinheiro

- poker esporte da mente

- roleta stand